Inventoriable and period costs are also a type of classification of costs. Inventoriable costs can be defined as costs that become part of inventories such as raw material, work in progress, and finished goods inventory present in the balance sheet of any business. On the other hand, period costs are all additional costs that are not inventoriable costs. Period costs are incurred and expensed in the Profit and Loss Statement in the period they are incurred.

Inventoriable Costs

Inventoriable costs, in a manufacturing concern, can be defined as all direct material, direct labor, and manufacturing costs. These costs are incurred while the product is being manufactured, but all of these are not expensed to the profit and loss accounts in the same period. These costs become part of 3 types of inventories and sit on the balance sheet. When these inventories became finished goods and sold, Inventoriable costs transform into the cost of goods sold, thereby part of the profit/loss statement.

Period Costs

In a manufacturing concern, period costs can be defined as all those costs incurred and expensed to profit and loss accounts in the same period. For example, administration cost, finance cost, and selling and distribution costs are period costs. These expenses do not give benefits in the future periods or are very difficult to evidence their benefit. Therefore, these costs are expensed to the P/L statement in the incurred period.

In a manufacturing concern, all the direct material, labor, and manufacturing expenses are inventoriable costs. Other costs such as administration, finance, and selling and distribution costs are period costs.

In trading concerns, the acquisition costs of goods sold in the same form are considered inventoriable costs. These would include the purchase cost of goods, inward freight cost, handling, etc., and all other costs which are necessary to bring goods in a position to be sold by the trader. Apart from these costs, all costs are the period cost for trading concerns.

In a service concern, all the costs are considered period costs because there are no inventories in the service sector.

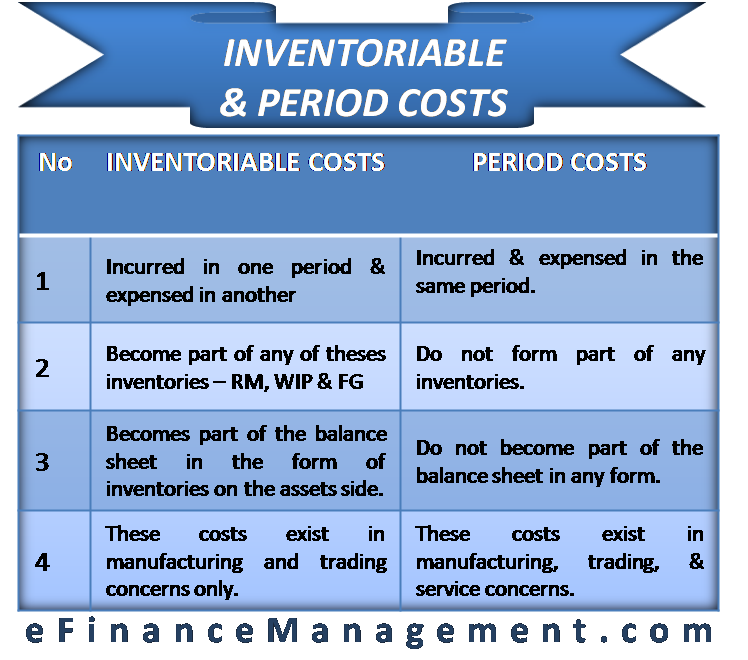

Difference between Inventoriable and Period Costs

| Sr. No. | Inventoriable Costs | Period Costs |

| 1 | These costs may be incurred in one period and expensed in another year. | These costs are incurred and expensed in the same period. |

| 2 | These costs become part of any of the three inventories – raw material, work in progress, and finished goods. | These costs do not form part of any inventories. |

| 3 | Becomes part of the balance sheet in the form of inventories on the asset side. | Do not become part of the balance sheet in any form. |

| 4 | These costs exist in manufacturing and trading concerns. | These costs exist in manufacturing, trading, and service concerns. |

To conclude, we can say that the inventoriable and period costs are differentiated because of the matching concept of accounting. Conceptual understanding of accounts says that we should record all those expenses in the P/L statements in the particular period, which are related to the revenues of that particular period. Since the benefit of inventoriable costs is also available to future periods, the part of inventoriable costs that benefit the future periods are taken to the next period and are inventoried in the balance sheet. On the other hand, the period costs normally tend to benefit the current period. No benefits of those expenses are normally available in the future period; these costs are matched to revenues of the same period.