What is a Joint Venture?

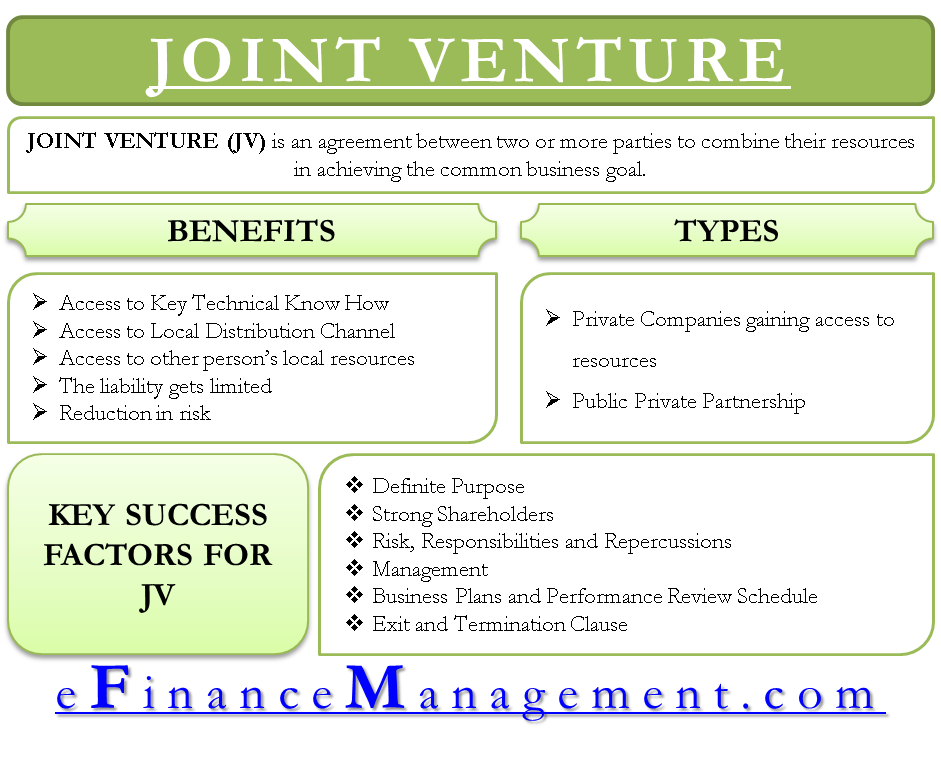

A Joint Venture (JV) is a corporate restructuring strategy. It is an agreement between two or more parties to combine their resources (generally: capital, know-how, execution capability, and local network) in achieving a common business goal. Unlike most partnership arrangements, Joint Ventures are for a limited duration and specific purpose.

Since each party to the JV contributes its core competency (resource), parties under JV can leverage upon their combined resources and achieve their business objective effectively and efficiently. Further, the combined effort made by all the JV entities improves the probability of success as against the individual effort.

Generally, the Joint Venture Agreement (JVA) is signed by all the parties involved in JV. A good JVA explicitly covers the objective/purpose for the formation of JV, liabilities, and rewards for each party against their respective contribution, term and termination clauses for JV, and governing laws in case of any dispute.

Benefits of Entering into a Joint Venture

Entering into a joint venture can offer several benefits for businesses. Here are some of the key advantages:

Access to New Markets and Resources

Joint ventures often involve collaboration between two or more companies with complementary strengths, resources, and expertise. By forming a joint venture, each party gains access to new markets, customers, distribution channels, or technologies that they may not have been able to access individually. This can significantly expand the business’s reach and potential for growth.

Also Read: Advantages and Disadvantages of Partnership

Risk Sharing

Sharing risks is one of the fundamental benefits of a joint venture. By pooling resources and expertise, the partners can spread the financial and operational risks associated with a new project or market entry. This can help reduce the individual risk exposure of each company and provide a more secure foundation for pursuing business opportunities.

Cost Sharing and Efficiency

Joint ventures allow companies to share the costs and expenses associated with a particular project or venture. This can include sharing research and development costs, marketing expenses, manufacturing facilities, or distribution networks. By sharing these resources, the partners can achieve economies of scale, increase operational efficiency, and reduce overall costs.

Enhanced Competitive Advantage

Collaboration through a joint venture can enhance the competitive advantage of the participating companies. By combining their strengths and expertise, the partners can create a unique value proposition, access new technologies or intellectual property, and gain a competitive edge in the market. This can help them compete more effectively against larger competitors or enter new markets with a stronger position.

Knowledge Transfer and Learning

Joint ventures facilitate knowledge transfer between the partnering companies. Each party brings its own knowledge, experience, and best practices to the table, allowing for mutual learning and the exchange of skills and expertise. This can result in a broader knowledge base, improved innovation, and increased organizational learning for all parties involved.

Also Read: Strategic Alliance

Flexibility and Adaptability

Joint ventures offer flexibility in terms of structuring and adapting to changing market conditions. The terms of the joint venture can be negotiated to accommodate the specific needs and objectives of the partners. Additionally, if market dynamics or business circumstances change, joint ventures can be adjusted, expanded, or dissolved more easily than other forms of long-term partnerships.

Shared Management and Decision-making

In a joint venture, decision-making is typically shared between the partners, allowing for a collaborative and cooperative approach to strategic planning and operational management. This can lead to better decision-making, as different perspectives and expertise are considered. It also fosters a sense of equality and mutual respect among the partners, strengthening the relationship and promoting long-term cooperation.

Read more about other corporate restructuring strategies.

Types of Joint Venture – with the Example

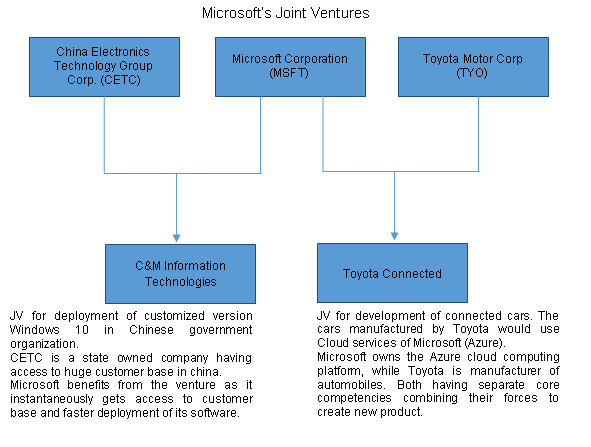

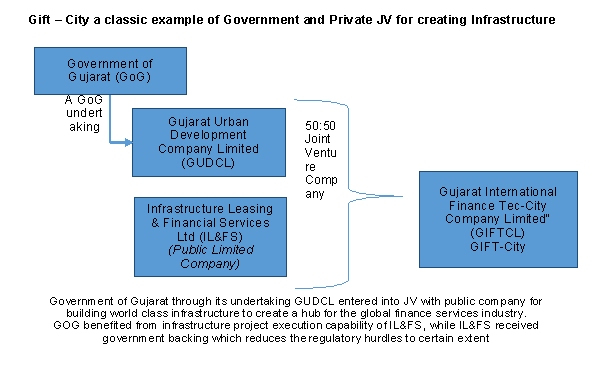

As mentioned earlier, joint venture entities bring their own core competencies to the table to achieve mutual benefits.

- Private Companies gaining access to resources / technical capabilities

- Government bodies for building infrastructure (Public-Private Partnerships)

Key Success Factors for Joint Venture

Definite Purpose

The objectives of all the parties involved in the JV should be aligned to a single business goal. This leads us to the key factor of JVA, i.e., purpose. The purpose of JV should be clearly spelled out in JVA, and all the parties should tend to benefit from it.

Strong Stakeholders

All the parties in JV should contribute their core competencies with the single objective of making a success out of JV. If JV partners have a hidden agenda of taking undue advantage of JV, such JVs are bound to fail. Hence, thorough due diligence of JV parties is needed. Moreover, trust between parties is also an important factor.

Risks, Responsibilities, and Repercussion

The JVA should clearly define the rewards (profit sharing), risks/liabilities, and repercussions on each party if the JV fails to deliver the desired results. The roles and responsibilities should be clearly defined and understood by all the entities involved.

Management

Parties need to understand that JV is not the branch or subsidiary. Hence, trying to gain undue management power or playing political games would not help the business objective. Having apt leadership in place will only improve the probability of JV success.

Business Plan & Performance Review Schedule

Before entering JV, each entity should prepare a detailed business plan separately. Assumptions made by both entities should be shared and made clear to each other beforehand. Moreover, the performance review should be planned beforehand so that both parties are on the same page for achieving the set business objective. The performance of JV evaluated early can save each entity from wasting its resources.

Exit / Termination Clauses

Generally, JV’s are created for a definite time and purpose. Hence, it favors all the entities if exit strategies are well documented. Though termination clauses are part of most of the JVA, it is recommended that disputes or differences between parties are resolved without formally invoking the termination clause.

Conclusion

Joint Ventures are the best and most effective way to undertake the business objective that requires capabilities that are over and above one entity’s core domain of business. By way of JV, entities can pool their resources and achieve the business goal with limited liability. Entering into JV reduces the cost of developing domain knowledge and improves the probability of achieving success.